How to use your Enneagram type strengths in a financial planning career

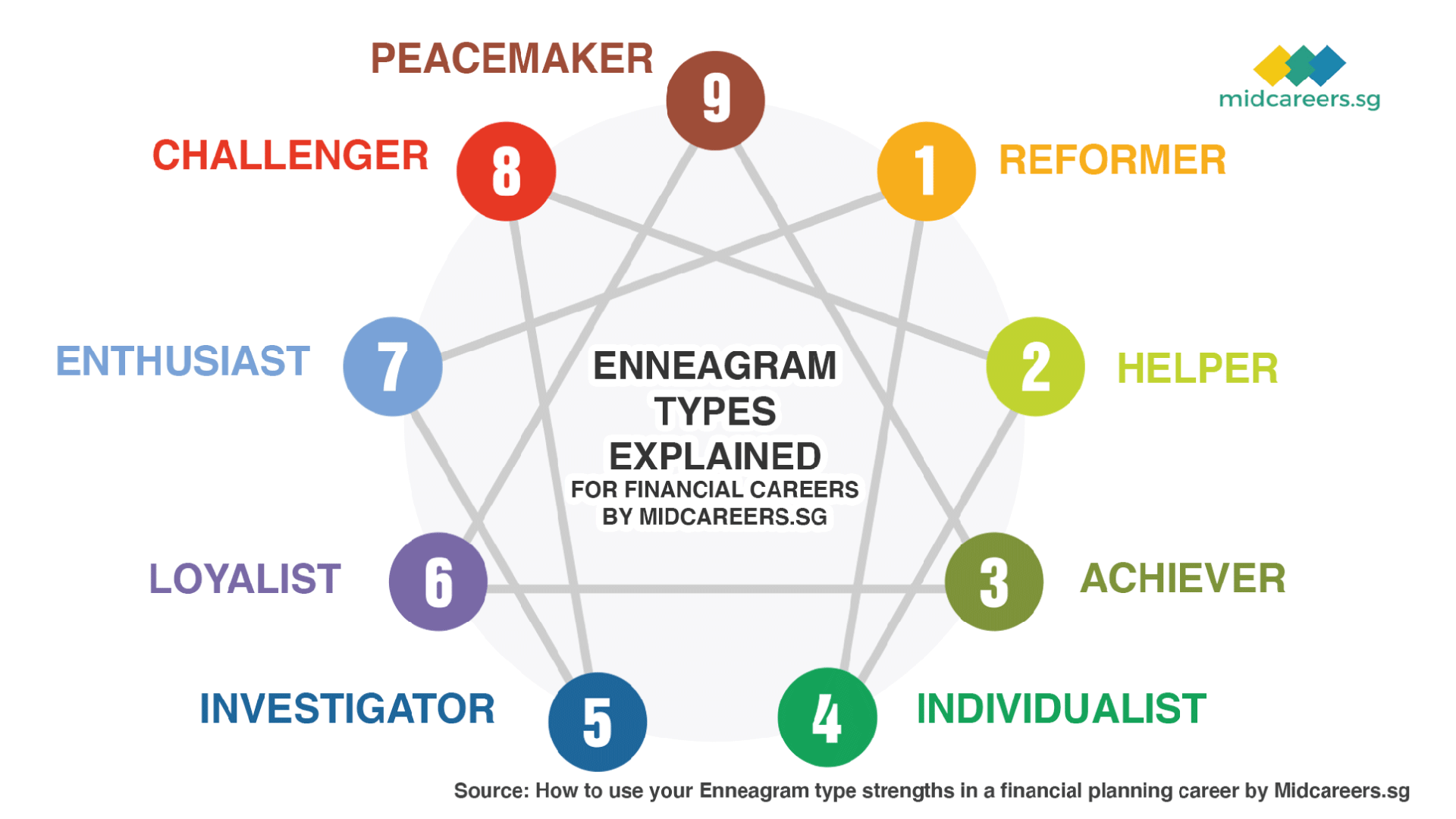

The Enneagram is widely known for identifying personality types, but its uses go beyond that. By understanding our Enneagram personality type, we can also determine our optimum work environment, and approach to our career; as such, it’s a way to leverage our strengths, and minimise our weaknesses. This is especially helpful to the self-employed, or to those in industries where you’re given leeway to determine your own work styles. Chief among these is the finance industry, and its financial planners – here’s how they can optimise their career through their Enneagram types.

Read on to find out more!

Caveat:

The nine Enneagram types are presented here in broad strokes. It’s important to get a more detailed and personalised analysis from a qualified coach; there are greater nuances to Enneagram types than can be presented in a single article.

In addition, cultural beliefs and past experiences can override a type’s behavioural patterns. For example, an Enneagram type 9 usually seeks to de-escalate conflict; but this may not be the case if the type 9 is dealing with a person they already had bad experiences with.

Do keep this in mind when reading the following.

Enneagram Type 1 – The Reformer / Perfectionist

- Specialise in detail-oriented work, such as in-depth policy comparisons

- Great at organising seminars, or fact-checking publications

- Works best with equally detail-oriented or “numbers” clients, but might struggle with clients perceived as too laid-back or flighty

This Enneagram type sets high standards, both for themselves as well as others. They can get a bit too hung up about getting every last detail right.

A typical Type 1 problem that we’ve encountered is the financial planner who, when writing an email, spent half an hour checking whether to use the word “incidents” or “incidences”.

But while others may poke fun at this, it is also a strength. A type 1 is one of the best personalities for the nitty-gritty of policy reviews, and most have no issues ticking all the boxes for compliance. A type 1 is the least likely Enneagram type to ever get into trouble with a mystery shopper.

This makes them excellent for any kind of detail-oriented work, including event planning. A type 1 is also a good pairing with clients who are themselves “numbers” people – that’s because a type 1 is less annoyed, or in some cases even delighted, to pore over the various charts, graphs, and ratios to explain them to clients.

Enneagram Type 2 – The Helper

- Caregivers at heart, great at working with clients who are underprivileged or have special needs

- Good at working with humanitarian and non-profit groups, a personality that appeals to impact and ethical investors

- Can get a bit too personally involved with client issues

This Enneagram type can be the doctors of financial health. They derive satisfaction from bringing healing and help. As a whole, most are happier at seeing their clients succeed, than in getting a bigger commission.

Since a type 2 is happy to go the extra mile, they’re often the best for handling clients who have special needs. Low-income clients, struggling single parents, business owners who were once bankrupted, etc. are all viable clients for them. Rather than being put off by the added difficulty, type 2’s may find joy in restoring these people to financial health.

This doesn’t mean a type 2 is confined to clients in difficulty. Their mindset is in tune with impact investors, or ethical investors. They can work well with clients who want to build green portfolios, for example, or who want to invest only in ESG companies; clients whose interest go beyond a slightly higher return.

While a dream for clients, type 2s are sometimes in danger of being too involved with a client’s issues. They must be careful not to become too smothering, and to not start dictating what a client needs “for their own good”.

Enneagram type 3 – The Achiever

- Driven by a need for recognition (personal or public), these financial planners are among the hardest and most productive workers

- Great at seeing past buzzwords and marketing spiels, to build portfolios that deliver real results

- Type 3’s can move a little too fast, and their decisiveness needs to be better tempered with forethought. They can be very impatient with more cautious clients

This enneagram type values results above all. While others feel stressed from work, type 3’s often feel stress from not working. They tend to have a strong competitive streak and need to see results, and have trouble stopping; if you tell them to relax, they’ll probably start looking ways to win the “most relaxed person” contest.

Type 3’s are great portfolio builders, especially when they see it as a personal challenge. Because they’re so results oriented, they quickly see past excuses and marketing buzzwords. When it comes to investing, a type 3 is the least likely to be swayed by a fund’s marketing or spokesperson; all they care about is having the best.

The downside to type 3’s is that they can be too quick and decisive. They may not take the time to listen and build rapport with their clients, and can end up with fewer long-term relationships. They’re often shocked when a client drops them, despite their high achievements.

Enneagram type 4 – The Individualist / Romantic

- Great at engaging otherwise disinterested prospects and clients; can make finance interesting through creative means

- Concerned over how their product or service is presented; they can think up better approaches than just showing numbers and graphs

- Can be a bit emotional, and may take even small rejection to heart

This is, overall, the most creative of the Enneagram types. Type 4’s are original, innovative, and have a keen eye for aesthetics. They can often come up with great ways to present something, ranging from intriguing infographics, or even videos and podcasts.

This makes them excellent prospectors, as they can engage even people who usually have no interest in finance. They also retain clients well, by constantly devising innovative ways to present otherwise dull details. If cold calling is involved, a type 4 has the best overall chance of grabbing a stranger’s attention.

It is a misconception that 4’s are all flighty. In fact, type 4’s are among the most resistant toward manipulation. They are themselves masters of sensory impact, and they recognise their own techniques being used.

Type 4’s do tend to be emotionally attached to their work, treating it as an expression of themselves. As such, many have a bad habit of taking rejection as a personal slight – they feel that a rejection of their work is also a rejection of their person, and this can make them prone to disillusionment.

Enneagram type 5 – The Investigator

- Type 5’s tend to excel in digging out information, fact-finding, and cataloguing data. They quickly develop in-depth knowledge of a particular field or product, becoming experts in certain asset or policy types.

- As knowledgeable strategists, type 5’s can be great at portfolio building, or investment approaches (e.g., tail-risk hedging, tortoise investing, and so forth)

- Type 5’s tend to enjoy concepts more than people, and often want to work with the portfolio but not the client. They may find appointments and “sales talk” to be a painful strain.

Type 5’s are natural fact finders, who often believe that success means knowing more. They tend to quickly develop in-depth technical knowledge, be it toward a certain type of insurance product, or an asset class like property, commodities, bonds, etc.

Most have a natural love for dealing with concepts. They are not put off by complications, and many have an almost encyclopedic range of knowledge in their field. A type 5 dealing with index funds can probably talk about synthetic ETFs versus partial ETFs, double-gold or bear ETFs, and cite fund performances in specific quarters on given years, all of the top of her head.

The love for concepts is also a weakness, however, as they often like the portfolio more than the client they’re managing it for. If given a choice, the typical 5 would like to almost never meet the client, and just manage their funds.

As reality doesn’t work this way, type 5’s must make especial effort to warm up to people; and they may need to push themselves to make face-to-face appointments.

Enneagram type 6 – The Loyalist / Skeptic

- Type 6’s protect the professional structures around them, by anticipating problems before they strike. They are naturals at perceiving risk, and maintain caution even in exuberant times

- Providers of level-headed advice, which can benefit individuals; but a type 6 really shines when working with corporate-level clients, as they often foresee multiple big-picture issues

- Their “devil’s advocate” approach can be off-putting. Because they keep pointing out potential problems, they can come across as a negative or demoralising force

Risk management is almost an inbuilt talent for the Type 6. While others are rushing to mine gold, these are the people hanging back and asking “what happens if we buy all this mining equipment and we don’t strike gold?”

Their level-headed approach, and love for structure, make them hype-resistant. Their influence stops clients from chasing get-rich-quick schemes; and their constant wariness can quickly spot and evade potential problems.

For this reason, a type 6 excels when dealing with corporate-level clients, or small businesses. They are good are analysing a wide range of potential risks, and making appropriate contingency plans. A portfolio built by a type 6 may seem “vanilla” on the surface, might show its ingenuity during downturns. Type 6’s often have a knack for designing well diversified, recession-resistant portfolios.

The downside is they struggle to get along with more reckless clients, and they’re quickly frustrated when dealing with high-risk appetites. They may also have more issues with teamwork, as others in the office may perceive them as being too negative.

Enneagram type 7 – The Enthusiast

- Fast and quick witted, these financial planners use their natural sense of opportunity to benefit clients; they seize advantages before others even notice they exist

- Versatile thinkers, often with knowledge or talents in multiple tangential fields; they bring a more holistic approach to investing, and prevent tunnel-vision among clients

- Can be a bit unfocused, running off to chase new opportunities instead of resolving existing problems. This can result in a lack of long-term commitment or follow-through

A type 7 is constantly on the lookout for new and exciting pursuits. In the finance industry, this same tendency alerts them to new opportunities, often long before others spot it.

From an investment perspective, a type 7 is more likely to embrace rather than fear volatility; and they’re highly resistant to sunk-cost fallacy. Their advantage is often just being the first to cut losses and move on to the next opportunity, while others are still moping and upset.

This makes it quite easy for type 7’s to work with sophisticated or risk-tolerant clients; type 7’s are often of the same mindset. A type 7 is also often eager to present new assets, investing approaches, or novel rebalancing schemes; this might cure clients of more myopic investing methods.

On the downside, a type 7 often copes with loss through avoidance, rather than real resolution. If a plan doesn’t work, they may not want to review it and restore it. Instead, they’d rather dump it and try and find a new opportunity altogether. At their worst, a type 7 may devise several novel plans, but with no follow-through on any of them; so these types need to be wary of losing focus.

Enneagram type 8 – The Challenger / Protector

- Natural leaders, type 8’s are great at starting collective efforts, and rallying teams

- Type 8’s are good at working with underdog or underprivileged clients, and will go to extreme lengths to fight perceived injustices

- While they’re good leaders, type 8’s often don’t like being led in turn; and it can be difficult for them to play the role of a follower when needed. This can cause friction with clients, when a type 8 is told to take actions they don’t agree with

Type 8 financial planners are among the most protective of their clients and co-workers, and can go to extreme lengths.

If a client has been deprived of a home, for example, most financial planners will simply try to calculate an affordable alternative. But a type 8 is liable to also fire off letters to Members of Parliament, post about the unfairness of the situation, or rail about it on social media.

This degree of commitment can make for strong bonds of loyalty, and adds to their natural leadership.

Type 8’s have a deep consideration for the truth, and are hard wired for a sense of fairness; they can work well with activist causes, and like to crusade against scams or deceit. This appeals to clients who prize loyalty and integrity.

On the flip side, type 8’s can be a bit too forceful and intense. Clients who are shy may find their personality discomforting, and in the office they can be very stubborn and difficult to lead. Type 8’s must learn to moderate these tendencies over time.

Type 9 – The Peacemaker / Mediator

- As natural diplomats, type 9’s help people with different values and views come to a common compromise. They have a knack for de-escalating conflicts

- In the finance industry, type 9’s tend to do well in organisations like family offices, or family-run businesses; they have a talent for navigating intense emotional conflicts, while still staying on track

- Due to their intense aversion to conflict, a type 9 can sometimes be seen as slow, or a people-pleaser; this may put off more result-oriented clients

Type 9’s are diplomats and mediators by inclination. Most are unusually skilled at defusing conflicts, and they can somehow make the most recalcitrant parties come to a compromise.

This is excellent when working in a family office, where social and financial goals often conflict. It’s also helpful for clients involved in family-run businesses. Overall, type 9’s have the best capacity for handling abrasive clients; they respond to aggression with calm, and turn ultimatums into mutually beneficial arrangements.

This doesn’t mean that type 9’s are happy to compromise all the time and give up on goals. In fact, most are heavily goal oriented, and go through extensive negotiations precisely to meet those goals.

Unfortunately, this means that solutions created by a type 9 tend to be slow-going, involving constant negotiation between different parties. Those who misunderstand type 9’s may look down on them as people-pleasers, or consider them ineffective. As such, clients who want immediate and near-term gains may find type 9’s unattractive.

This is a general outlook on how to use your Enneagram type strengths, but it’s best to have a personalised approach!

To know about your enneagram type, you can take a full test here, and consult a qualified Enneagram coach, for actionable steps on how to optimise your career.

If you’re considering switching to the finance industry, or are already in it but are seeking progress, reach out to us at Midcareers.sg. We can help you to start or advance a career in finance, even if you’re from a different background.

Career Fit Tool

Complete the Enneagram test and receive your personalised report @S$20 from our veterans.